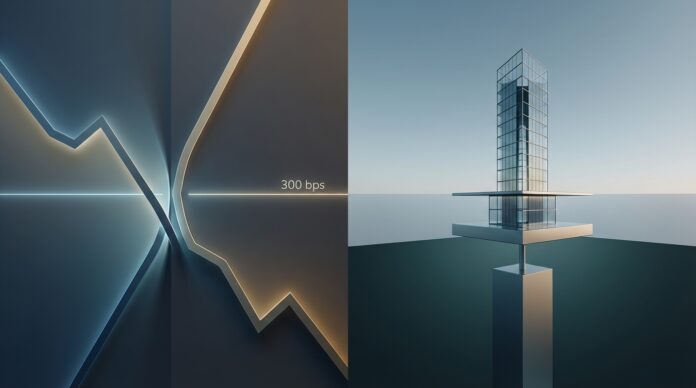

The Lead: Public Credit Markets Signal “Risk-On”

As of mid-December 2025, the public high-yield bond market has firmly entered “priced for perfection” territory. The ICE BofA US High Yield Index Option-Adjusted Spread (OAS)—the primary barometer for credit risk sentiment—has tightened to 2.88% (288 basis points). This compression below the psychological 300-basis-point threshold signals an aggressive “Risk-On” environment where investors are displaying a high tolerance for risk in exchange for yield.

This level of tightness is historically significant. Spreads are trading well inside their long-term averages, suggesting that public market participants are pricing in a “soft landing” scenario with near-zero expectations of near-term corporate defaults. Fluctuations remain minimal, with spreads hovering between 2.85% and 2.91% throughout early December, painting a picture of a market awash in liquidity but offering very little compensation for downside protection.

The Trend: Yield Compression Across the Credit Stack

The appetite for risk is evident even in lower-rated tranches. The ICE BofA Single-B US High Yield Index OAS sits at a mere 2.97%. Typically, investors demand a significantly higher premium for holding Single-B rated paper compared to the broader index, but the current spread differential has collapsed. This indicates that capital is chasing highly levered issuers, accepting thinner margins of safety to deploy cash.

Institutional managers are noting the asymmetry of the current trade. With spreads this tight, the potential for capital appreciation via further spread compression is mathematically limited. As noted by analysts at State Street, high-yield credit currently offers “limited upside from spreads” and lacks the “right tail” potential seen in equities. The market is essentially paying investors a coupon to wait, but the capital cushion against any macroeconomic shock is exceedingly thin.

The Implication: Discipline Over Deal Flow

For corporate borrowers, the public markets currently offer attractive rates, often accompanied by loose covenants as lenders compete for allocation. However, this euphoria creates a dangerous dynamic: terms are being agreed to that may not withstand a turning economic cycle.

In this overheated environment, Bond Capital maintains a contrarian stance. While public markets aggressively loosen terms to win deals, we prioritize credit discipline. Use of proceeds and structural downside protection carry more weight than simply securing the lowest possible headline rate. We believe that true partnership is proven not when liquidity is abundant, but when the cycle turns. By refusing to chase “covenant-lite” structures just to deploy capital, we ensure we remain a stable, solvable partner for our portfolio companies when volatility inevitably returns.