Aggressive Tightening Into Year-End

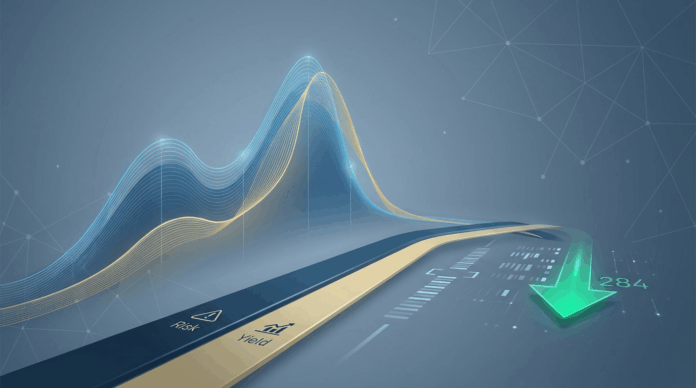

The public high-yield market is closing 2025 with a definitive “risk-on” signal. According to the latest data, the ICE BofA US High Yield Index Option-Adjusted Spread has tightened to 2.84% (284 basis points) as of December 24, down from 2.95% just one week prior. This compression signifies a market flush with liquidity, where investors are increasingly willing to accept historically low premiums for credit risk to secure allocations.

Sector Watch: The Quality Compression

The rally is broad-based, squeezing value out of the higher tiers of non-investment grade debt. BB-rated bonds, the highest quality cohort within the junk universe, saw spreads compress to a razor-thin 1.72%. Meanwhile, the riskier Single-B index tightened to 2.96%, breaking through the psychological 300bps barrier. Even the most speculative segment, CCC-rated securities, participated in the rally, closing at 8.75%—down 16 basis points on the week. This unified compression across the credit curve suggests that public market investors are capitulating on price and structure to deploy capital before the year ends.

Implications for Borrowers

For corporate issuers with access to public capital markets, the window is currently wide open. The prevailing pricing implies a market “priced for perfection,” assuming a stable macroeconomic backdrop and minimal default rates heading into 2026. However, history suggests that such aggressive tightening often precedes volatility. When spreads are this thin, they offer little to no cushion against unexpected economic shocks or interest rate variances.

The Bond Capital View: Discipline Over Velocity

While public markets chase yield at any cost, Bond Capital maintains a disciplined posture. In an environment where average high-yield spreads dip below 300bps, we believe the public market is actively underpricing risk. This is the classic “Risk-On” trap: liquidity is abundant, and terms are loose, but the downside protection for investors is eroding.

We view this as a critical moment to prioritize structural integrity over deal volume. While banks and syndicates loosen terms to win mandates, Bond Capital continues to focus on senior-secured private credit with robust covenants. We provide borrowers with certainty of execution—not because we ignore risk, but because we structure for it correctly, regardless of the temporary euphoria in the public indices.