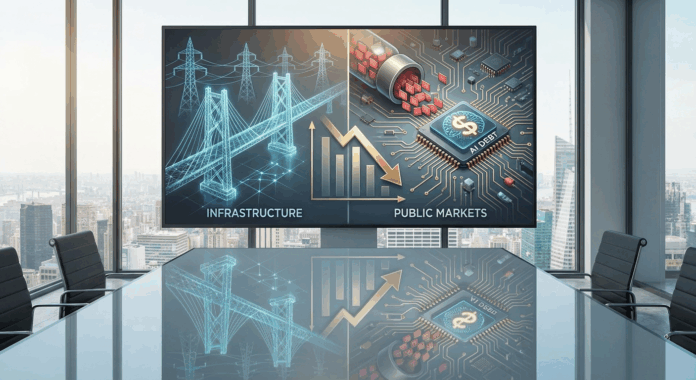

The Shift from Equity Buzz to Debt Reality

For the past two years, the artificial intelligence narrative has been dominated by equity valuations and semiconductor shortages. As we close 2025, the story has fundamentally shifted to the balance sheet. The physical build-out of the AI ecosystem—data centers, power grids, and cooling systems—is presenting an estimated $5 trillion to $7 trillion financing bill, and public credit markets are showing signs of indigestion.

Major hyperscalers, including Meta, Amazon, and Oracle, have flooded the market with record-breaking bond issuances to fund this capital expenditure. Meta alone secured nearly $30 billion in financing recently, while Amazon followed with a $15 billion sale. While these entities possess pristine credit ratings, the sheer volume of paper hitting the street is testing the structural limits of institutional investors.

The "Concentration Wall" and Market Indigestion

A critical, under-reported friction point is emerging: concentration risk. Pension funds and insurance portfolios operate with strict sector caps—typically limiting exposure to any single industry or issuer to 3-4%. With the technology sector aggressively issuing debt, many institutional portfolios are hitting their ceilings.

We are observing the immediate effects of this saturation:

- Widening Spreads: Despite strong fundamentals, issuers are paying higher premiums to clear the market. Oracle’s credit default swaps (CDS) recently spiked to levels not seen since 2009, reflecting growing investor caution regarding massive capital outlays.

- The Crowding Out Effect: As Grade-A tech giants soak up available liquidity, traditional industrial and infrastructure borrowers face steeper execution hurdles and pricing pressure.

- Volatility in "Risk-Free" Assumptions: The assumption that big tech debt is a risk-free parking spot is being challenged by the uncertain ROI of these massive infrastructure projects.

Private Capital: The Certainty in a Volatile Market

The current volatility in public debt markets underscores the strategic necessity of private credit. As public order books become crowded or capped out, private capital offers a distinct advantage: flexibility and certainty of execution. J.P. Morgan estimates that private credit and government funding will need to plug a gap of roughly $1.4 trillion to meet the sector’s demands.

For developers and mid-market infrastructure firms, relying solely on public bond issuance is becoming a gamble on market timing. The "Risk-Off" sentiment generated by fears of an AI supply glut means that financing windows can close abruptly.

What This Means for Borrowers

We are entering a period where access to diverse pools of capital is paramount. While banking syndicates and public markets struggle with concentration limits, Bond Capital remains focused on asset fundamentals. We understand that steel, concrete, and power contracts hold intrinsic value, regardless of the daily volatility in tech credit spreads.

For borrowers, the message is clear: The public market’s appetite is vast but finite. As sector limits are reached, the stable partner will be the one who can underwrite the asset complexity without being constrained by index weighting caps. In an environment where public liquidity is becoming expensive and selective, private credit remains openly available for well-structured infrastructure projects.